I'm coming for your candy canes in my penultimate Advent Policy Brief. Strap in for a nuanced twist on the unpopular sugar tax proposals that circulate in health policy circles perennially. I don't support a tax, but I do support a tariff.

Tariffs and taxes have the same end effect of raising consumer prices. In Pigovian applications, fees discourage undesirable products and transactions. Tariffs internalize geopolitical consequences of international trade. Until COVID, those geopolitical consequences didn't need to factor in airborne pathogens. Since, the wisdom of local production has become undeniable.

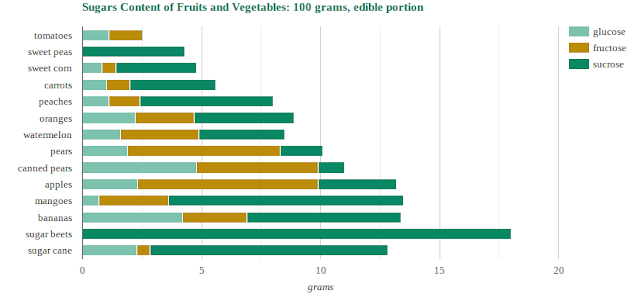

Sugar cane only grows in hot wet climates, but Canada is an under-developed sugar producer via sugar beets. Sugar beets are commercially grown in Alberta and Ontario, but they're suitable for farming broadly across the country. Hat tip to sugar.ca for the factoids:

Our sugar imports are more than million tonnes greater than our sugar production.

Yes, a tariff on sugar means prices will increase, and ideally, sugar consumption overall will decrease. Refined sugar products are believed to be at the root of many health problems and responsible for billions of dollars in direct health costs. Sugar self-sufficiency is within reach for a huge country like Canada. Our sugar crops just need a heap of sweet sweet protectionism.